The intelligent corporate card platform for modern finance teams.

Issue cards to your whole team, manage expenses, save thousands on FX fees, and earn rewards points - all with Australia’s best business credit cards. Onboard in minutes, not months.

The all-in-one spend management platform

Issue cards to your team instantly, easily manage expenses, save thousands on FX fees and earn rewards points, all with Australia's best corporate credit cards.

Trusted by Australia’s fastest growing businesses

Archa has been recognised across the industry as Australia’s best corporate card offering, best spend management product, and best in class for rates and fees.

Simplifying spend at all sizes

From early-stage startups to established enterprises, Archa powers smarter spending on a single platform built to simplify business spend at every stage of growth.

Solutions for

Small Business

Fast and flexible. Get cards for your team in minutes without paperwork or personal guarantees. Automate receipts, sync to accounting, and remove reimbursements so you can stay focused on growth.

Solutions for

Mid-size Companies

Scale with control. Issue cards, set spend limits, track in real time, and connect to your accounting platform. Cut admin, speed up reconciliation, and give finance clear visibility.

Solutions for

Enterprise

For complex organisations, Archa gives full visibility across multiple locations, robust controls for teams and departments, and vendor-specific cards. Finance leaders gain insight, compliance, and confidence while keeping spend management simple at scale.

Partner with Archa

Whether you’re advising clients, building integrations, or embedding finance solutions directly, Archa makes it simple to add value and scale your offering.

Accountants

Give your clients smarter ways to manage spend while strengthening your advisory role. Archa helps accountants and their clients automate reconciliation, reduce manual admin, and deliver real-time financial insights, so you can focus on strategy, not chasing receipts.

Integration Partners

Build on Archa’s platform to create seamless integrations and custom workflows. Whether you’re embedding payments, connecting finance tools, or powering new products, our APIs make it simple to add value fast.

Powered by Archa

Launch your own branded spend management solution with Archa’s infrastructure. We provide the technology, compliance, and card-issuing capabilities so you can deliver a market-ready product without the complexity.

Frequently asked questions

Archa provides a corporate charge card facility. Unlike prepaid cards that require you to top up funds, Archa offers a dynamic credit line with monthly settlement terms. This means you can manage your cash flow effectively and keep your capital working for your business, rather than tying it up in a prepaid or debit account.

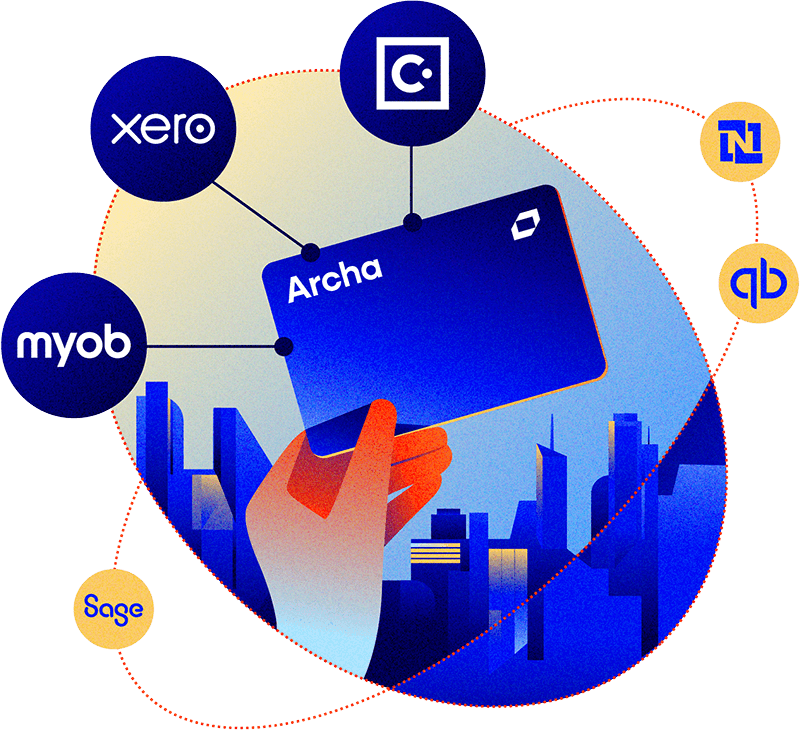

Yes. We view the card as an extension of your finance stack. Archa offers deep, native integrations with Xero and MYOB Acumatica, and connects seamlessly with others. With our native integrations, we automate the flow of transactions, receipts, and GL codes so your books are always up to date. For others, we provide customiseable export reports for easy upload.

Likely thousands. Traditional banks usually charge a 3% margin on every foreign transaction. Archa charges 0%. Whether you are paying for US-based software subscriptions (like AWS, Slack, or Google) or sending a team overseas, you pay the raw Mastercard market rate, keeping the savings in your business.

No. Archa eliminates the need for physical storage. When you pay with an Archa card, the app prompts you to snap a photo instantly. Our technology digitizes the receipt, extracts the key info, and attaches it to the transaction record in your accounting software. It’s fully tax-compliant and audit-ready.

We offer two layers of control. First, you can set controls on cards. These include max spend limits, monthly limits, single use cards, among a range of other controls. Coming soon, our AI Expense Agent acts as an always-on auditor, reviewing 100% of transactions against your company policy to flag anomalies or out-of-policy spend instantly.

Archa turns your operational spend into business growth. You earn points on eligible business expenses, which can be redeemed for airline flight credits to offset travel costs or other rewards with our partners. Plus, cardholders receive complimentary business travel insurance.

Instantly. You don't need to visit a branch or fill out paper forms. You can issue a virtual card to a new hire's phone in seconds, allowing them to start spending immediately via Apple Pay or Google Pay. We also offer single-use cards, temporary cards, and physical cards.